What is real DeFi and why are we not currently using it?

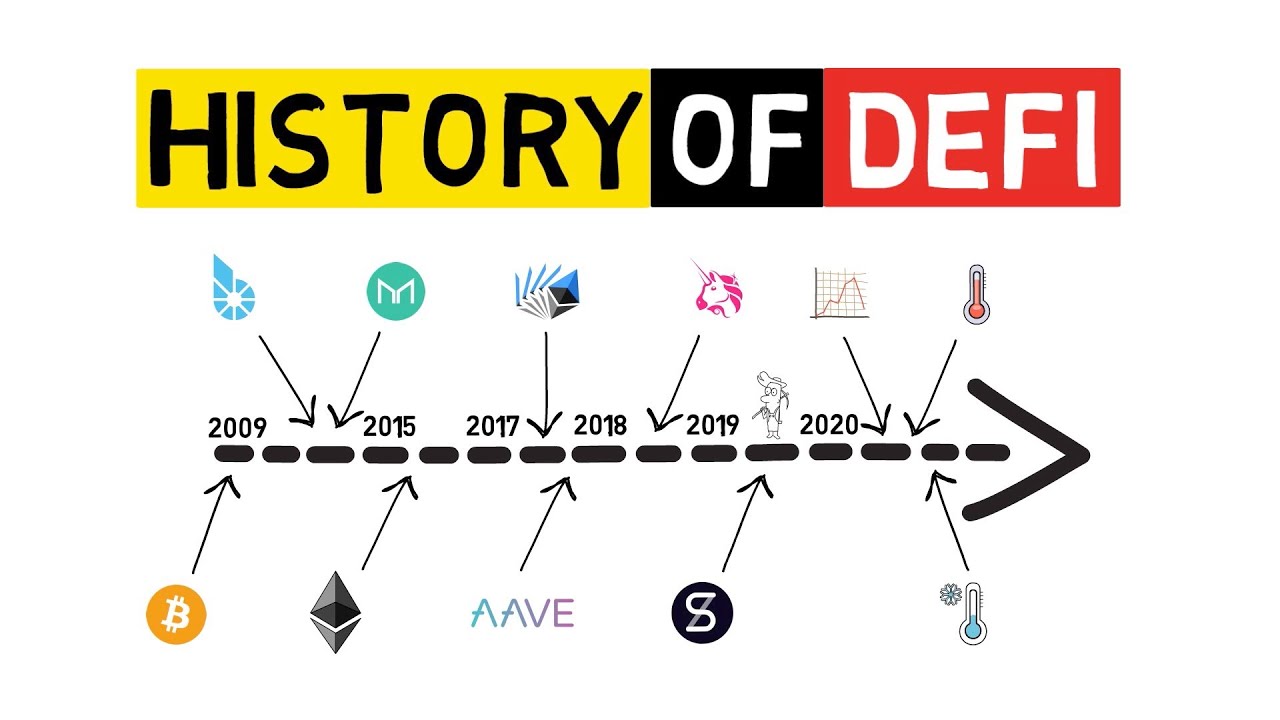

Decentralized Finance (DeFi) is the most exciting and powerful application of distributed ledger technology. Through the power of blockchain technology, it promises an autonomous financial ecosystem that is beyond the control of individuals, entities and regulators.

DeFi is growing rapidly. Today there are hundreds of projects and many more are in the works. But, despite the obvious benefits of DeFi, hundreds of thousands of cryptocurrency users still use centralized platforms that are managed or controlled by a central entity.

DeFi is growing rapidly. Today there are hundreds of projects and many more are in the works. But, despite the obvious benefits of DeFi, hundreds of thousands of cryptocurrency users still use centralized platforms that are managed or controlled by a central entity.How come?

Decentralized finance vs centralized finance

Centralized Finance (CeFi) is the traditional market structure in which centralized entities control the access and movement of funds. It is dominated by centralized entities (companies, governments, organizations), which define and control the system. These entities can exercise extreme control and choose who to work with. They can censor or ban, and they can also be censored or banned.

At CeFi, centralized companies act as intermediaries. This allows them to exercise significant control over your funds. Banks are a perfect example.

“If you call it centralized,” he says Warren WhitlockFounder and CEO of Stirling, “everything has to go through a single hub. If I want to send you money, the simplest of financial transactions, I send it to the bank and the bank sends it to you … If you have a bank and I have a bank, so they have to get along “.

In the crypto space, centralized financial entities can offer similar services to banks. But how Wendy OSoCal Crypto Meetup Host and Youtube Crypto Educator, says: “They are not real banks, because there is no consumer protection. They are not run by these very strict entities that have to apply for licenses and comply with regulations.”

DeFi, at least true DeFi, is the exact opposite of CeFi. It introduces a peer-to-peer approach to finance that brings more power into the user’s hands.

There is no central authority in DeFi to control and coordinate matters or to control access to funds. Therefore, it is more resistant to censorship and regulatory action than CeFi. Users are also in control of their own funds. And because DeFi transactions happen on blockchain, DeFi is transparent.

“When we talk about DeFi, we look at the protocols, the customers, the customers, who have control over their funds to some degree … DeFi is like you are your bank to some degree,” says Wendy O.

“When we use blockchain technology, everything is on-chain; for the most part, you can see it unless there is a cash deal off the stock exchange, or, you know, sometimes there are OTC deals being made.”

But despite these advantages, many people still choose centralized protocols.

CeFi’s appeal

Centralized finance appeals to the normal person more than decentralized finance. Even in cryptocurrencies, initially designed to be decentralized, most people rely on CeFi protocols with their own funds.

The main reason for this is that people feel safe investing their money in centralized finance protocols. On the other hand, they consider DeFi projects to be riskier, especially when it comes to investments.

This is near to the truth. Many DeFi projects offer unrealistic rewards to attract as many investors as possible. This model may work in the short term but is unsustainable in the long term. It makes investing in DeFi protocols very risky, especially considering that many DeFi projects fail.

This risk is too high, even for experienced investors. Wendy O explains why she preferred centralized platforms like Celsius and Voyager:

“One of the reasons I would do this was because the rates they were offering, like 8%. It’s not necessarily high. Many staking platforms and farm pools on decentralized protocols were returning 100% APY, 50%, 40%, etc. And for me it was super, super risky. So, I feel like a lot of people felt safe because we were looking at the lowest rates. ”

CeFi is also generally cheaper than DeFi. Take cryptocurrency exchanges for example. Centralized Exchanges (CEX), like Binance, offer a single platform where the user can find most of the tokens they need. On a CEX, traders can easily and conveniently trade tokens from different chains.

But this is not the case with decentralized exchanges (DEX). A DEX usually restricts the user to tokens compatible with the blockchain on which they were built. Therefore, if a trader wants cryptocurrencies from different blockchains, he has to use multiple exchanges or use bridging platforms, which takes a long time.

When DeFi is not true decentralized finance

There is another problem besides CeFi’s colossal appeal. Most DeFi projects are not truly DeFi. Instead, they have some CeFi features.

The tone goesformer Wall Street Quant and founder of FinSummit, says, “Everything in the DeFi space is pretty much the same as in the traditional financial space. It’s just different people doing it. And they use different terminology. Instead of the word database, they use the word blockchain, to example.”

It’s easy to see why. Many DeFi protocols aren’t truly decentralized. They can operate autonomously, but as centralized entities, they have effective oversight of control by a group or individual. Projects have teams behind them, which act as councils or development groups, holding meetings and making key decisions to determine their direction.

This has some significant implications. For example, a project will suffer if it loses a key figure or decision maker. It also leaves the project vulnerable to regulatory action because regulators can influence a project by identifying key people.

What’s next?

True decentralization is needed to create successful DeFi projects that will revolutionize the space.

“It’s almost like the Internet itself, where the Internet has helped a lot of companies, but it’s the same company,” says Tone, “Netflix is the same company as Blockbuster. They just used the Internet and got rid of Blockbuster. Amazon is mail order, only they use Internet and have become one of the largest companies in the world. ”

A project that is taking decentralization seriously is Sifchain. For one, it’s building a decentralized Omni-Chain exchange that will allow users to trade their favorite tokens in one place. Once ready, this project will make DeFi much more affordable.

But perhaps more important is that the project is managed internationally as a decentralized entity. It’s not really based in a place with a home office address. Instead, the front end for the DEX and the node structures are completely decentralized.

This process is continuous and innovative solutions are developed and improved every day. Even within the blockchain ecosystem itself, projects that aren’t innovating are quickly overtaken by competitors who can do more. This has created an incredibly fast-paced environment that continues to create some of the most unique and revolutionary ideas seen in this century.